Bookkeepers in Richmond, VA

8 locations found near Richmond

View Map“I spoke to Rhea and she was very knowledgeable in personal and business taxes. I didn't know what to ask, but she made sure she relayed any information in regards to my situation.”

“Dana and Arlene do the taxes for my business and they've done the personal taxes for myself and all of our employees for the past couple of years. Always responsive, pleasant, and very well versed in all things tax/accounting related. Highly recommend!!”

“Taxes can be hard, but with this particular business it was made much more easy! If you do choose to come here you wont regret a thing, They speak Spanish/English”

“Michelle is literally the best! She’s been doing my taxes for years and always gets me the best/biggest amount possible! Highly recommended & she charges a very affordable amount!”

9AM - 5PM

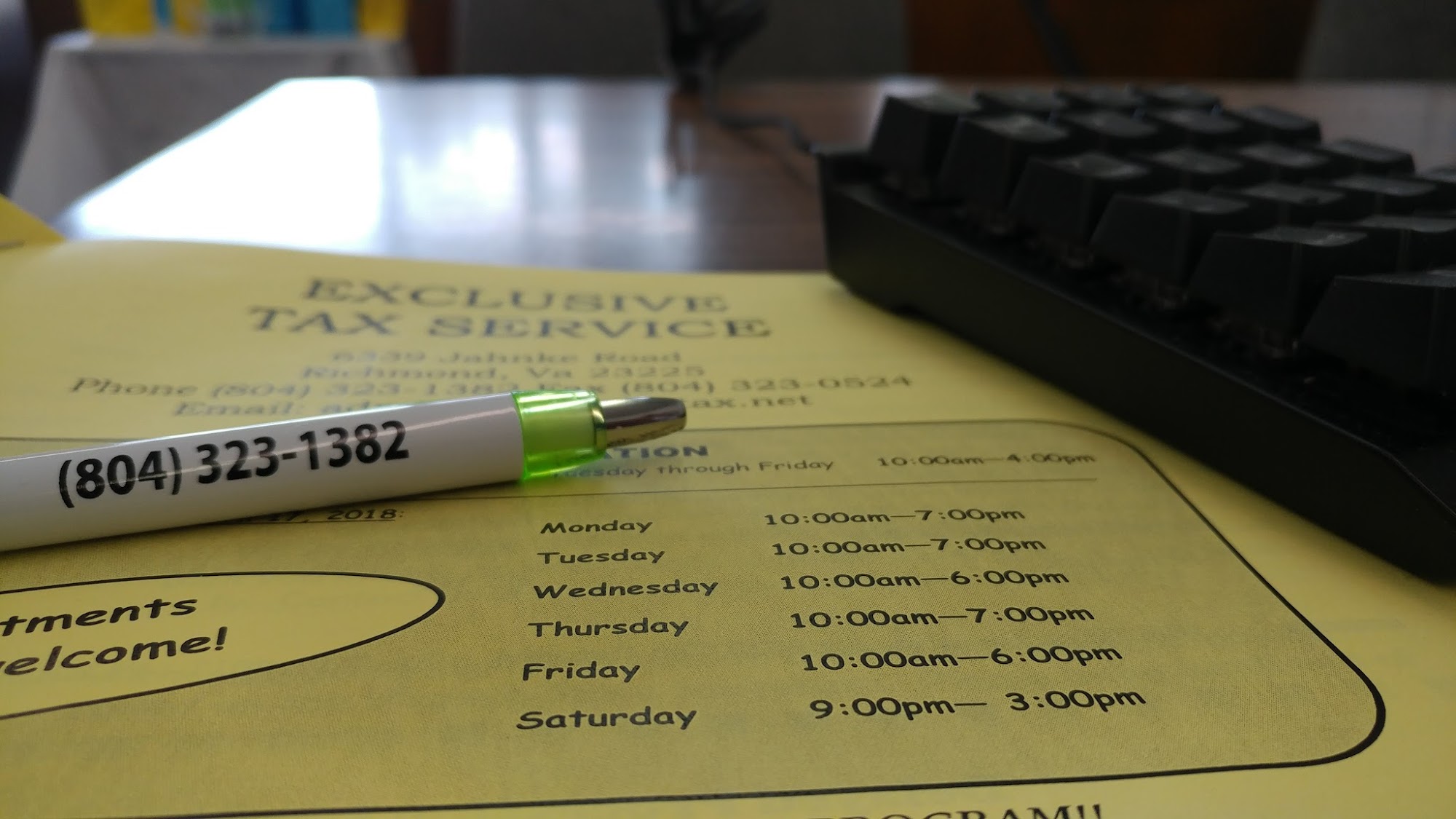

601 Turner Rd, Richmond Bookkeepers

Bookkeepers

“In response to above.Mr. Austin Samuels of Charlotte NC. We communicated via email since you moved to NC. I completed your tax return and informed you on 04/15/2019, that you owed the IRS and the State of NC.Since I didn’t hear from you, I even file and extension to allow you time to determine how to pay the IRS and State of NC. In the 04/15/2018, I informed you to CALL the office to discuss your tax return and options. YOU NEVER CALLED the office.Since YOU owed the IRS and State, I informed YOU that YOU needed to mail tax return. I do not e-file or mail (since you owe) IRS returns unless reviewed by the client and approved by calling the office and verbally communicating how to proceed. I cannot communicate with your mother on these tax issues, you are of age to handle YOUR personal taxes.This office has been doing taxes for over 25 years and has completed over 10,000 tax returns, we value our clients. The professionals at this office stand by our services and are available at any time at any of our locations. Many of our clients even have our personal cell phones to contact us. We are available.FYI.1. If you are to file a complaint, please use your real face and name not an alias.2. You never called this office in 2020 or any other communication.3. You never paid the fees for preparing the 2018 tax return which that in itself makes the not a valid complaint.4. Since you owed the IRS, you need to file the taxes that you owed before you can receive a Stimulus Check”

Bookkeepers

Bookkeepers

Bookkeepers

Bookkeepers

Bookkeepers

Bookkeepers

Bookkeepers

Bookkeepers

Bookkeepers

Bookkeepers

“This was such a refreshing experience. Mr Hall is very professional and knows what he's do I need. He is highly recommended by me. If I could give him 10 stars I would. Thank you Mr. Hall.”